Car title loan debt consolidation streamlines repayment for multiple high-interest car debts using vehicle collateral. Eligibility requires clear vehicle title, stable income, and employment history. Online applications initiate the process, with flexible payment plans and title transfer options available. Repayment is structured as monthly installments over a set period, emphasizing responsible financial management and comparing lender deals to secure best terms.

Looking to simplify your debts? Discover how car title loan debt consolidation can help. This comprehensive guide breaks down everything you need to know about this powerful financial tool. We explore what car title loan debt consolidation is, assess your eligibility for this option, and provide proven strategies to qualify and repay seamlessly. Take control of your finances today with our expert insights.

- Understanding Car Title Loan Debt Consolidation

- Evaluating Your Eligibility for Consolidation

- Strategies to Qualify and Repay Effortlessly

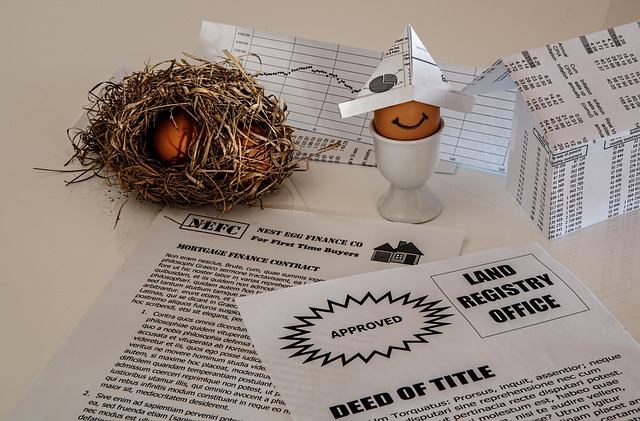

Understanding Car Title Loan Debt Consolidation

Car title loan debt consolidation is a strategy to streamline multiple high-interest car-related debts into one manageable loan, using your vehicle as collateral. This approach allows borrowers with several outstanding loans on their vehicles to simplify repayment and potentially save money on interest costs. By consolidating these debts, individuals can reduce the stress of managing multiple payments and may even improve their credit score over time.

This process involves using the vehicle’s title as security for a new loan that pays off existing debts. It is particularly appealing to those with less-than-perfect credit or limited options for traditional loans due to high interest rates associated with bad credit loans. A Title Pawn, where your vehicle’s title is temporarily held as collateral, can provide access to immediate funds. However, it’s crucial to understand the terms and conditions thoroughly, as failure to repay can result in losing ownership of your vehicle.

Evaluating Your Eligibility for Consolidation

Before considering car title loan debt consolidation, evaluating your eligibility is crucial. This process involves a comprehensive assessment of your financial situation and credit history. Lenders will perform a credit check to determine your creditworthiness and assess the value of your vehicle as collateral. The primary goal here is to ensure that you can manage the loan payoff without causing further financial strain. If your credit score meets the lender’s requirements, and your vehicle has sufficient equity, you’re likely a good candidate for consolidation.

Car title loan debt consolidation offers an attractive solution with quick funding. However, it’s essential to understand that this option may not be suitable for everyone. Lenders typically look for borrowers who can demonstrate consistent income and responsible financial management. Additionally, the interest rates and repayment terms vary among lenders, so comparing different offers is vital. This ensures you secure the best deal possible, making the consolidation process a smooth and beneficial experience.

Strategies to Qualify and Repay Effortlessly

When considering car title loan debt consolidation, understanding your eligibility is key to a smooth process. Several strategies can help you qualify and manage repayment effortlessly. Firstly, ensure you own a vehicle with a clear title, as this serves as collateral for the loan. Additionally, maintaining a consistent income stream significantly improves your chances, demonstrating your ability to repay. A stable employment history is also advantageous.

To initiate the process, complete an online application, providing detailed information about your vehicle and financial status. This facilitates an initial assessment of your eligibility. Once approved, explore flexible payment plans tailored to your budget. Some lenders offer title transfer options, allowing you to retain ownership while repaying the loan. Repayment is typically structured as monthly installments, ensuring manageable payments over a predetermined period.

Car title loan debt consolidation can be a powerful tool to regain financial control, but qualifying requires careful evaluation. By understanding your current financial situation, assessing your ability to repay, and employing strategic approaches, you can increase your chances of success. Remember, a well-planned consolidation strategy not only simplifies repayment but also paves the way for a brighter financial future.