Car title loan debt consolidation simplifies multiple high-interest loans by using vehicle equity to secure a single loan with better terms. Online tools track loans, offer flexible repayment plans, and calculate interest rates, making management easier. This strategy saves money by lowering interest rates and providing more manageable payments over the long term.

In the modern financial landscape, car title loan debt consolidation offers a strategic path to manage high-interest rates. This article delves into the intricacies of car title loan debt consolidation, providing insights on how to efficiently navigate this process online. We explore top tools designed to simplify management and outline benefits and repayment strategies for those seeking to regain financial control. Understanding these options is key to making informed decisions regarding your car title loan debt.

- Understanding Car Title Loan Debt Consolidation

- Top Online Tools for Efficient Management

- Benefits and Strategies for Repayment

Understanding Car Title Loan Debt Consolidation

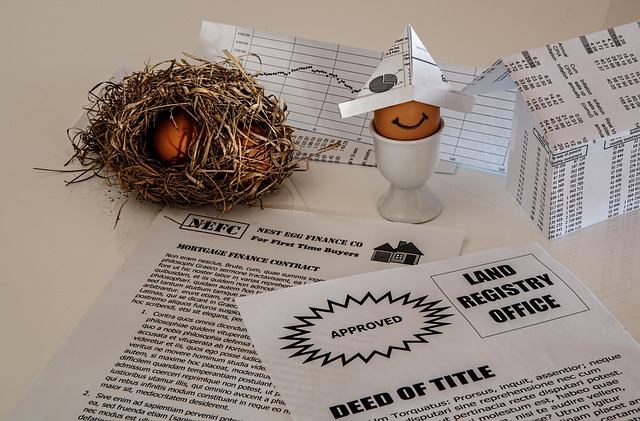

Car title loan debt consolidation is a strategic financial move for individuals burdened by multiple short-term car title loans. These loans, often characterized by their quick approval process and minimal requirements, can trap borrowers in a cycle of high-interest payments. By consolidating these debts, borrowers can simplify their repayment structure and potentially lower their overall interest rates. This approach leverages the vehicle’s equity to secure a new loan with more favorable terms, allowing individuals to regain control over their finances.

The process involves using the vehicle’s title as collateral for a single loan that covers all existing car title loans. A thorough credit check is usually conducted to assess the borrower’s eligibility and determine the consolidated loan amount based on the available vehicle equity. This method offers relief from multiple monthly payments, making it easier to manage finances and potentially save money in the long run. Borrowers should carefully review the new loan terms, including interest rates and repayment periods, to ensure they align with their financial goals and capacity.

Top Online Tools for Efficient Management

In today’s digital era, managing car title loan debt consolidation doesn’t have to be a challenging task. Top online tools offer efficient solutions tailored for this specific need. These platforms provide users with an accessible and user-friendly interface to track their Secured Loans, monitor repayment progress, and explore various Repayment Options. By leveraging vehicle equity, these tools empower individuals to gain control of their financial obligations and make informed decisions regarding their Car title loan debt consolidation.

Many of these online tools offer advanced features such as customized payment plans, interest rate calculations, and real-time updates on loan balances. They simplify the process by connecting borrowers directly with lenders, streamlining communications, and ensuring transparency throughout the consolidation journey. This not only saves time but also reduces the risk of errors, making it a convenient and effective strategy for managing Car title loan debt consolidation.

Benefits and Strategies for Repayment

Car title loan debt consolidation offers a strategic approach to managing and repaying high-interest debts quickly and effectively. One of the primary benefits is the ability to secure a lower interest rate, which can significantly reduce the overall cost of borrowing. This is particularly advantageous for car title loans, where rates tend to be higher due to the collateral nature of the loan. By consolidating, borrowers can access more favorable terms, making their repayments more manageable and allowing them to save money in the long run.

Strategies for repayment focus on creating a structured plan that aligns with the borrower’s financial capabilities. A popular approach is to prioritize debt snowballing, where smaller loans are repaid first to gain momentum and psychological satisfaction. Alternatively, the debt avalanche method involves targeting high-interest debts first, ensuring borrowers save more in interest charges over time. Online platforms play a crucial role here, providing easy access to tools for budget tracking, flexible payment options, and quick approval processes. An Online Application allows users to initiate the consolidation process remotely, saving time and effort compared to traditional methods.

Car title loan debt consolidation is a strategic approach to managing high-interest loans, offering relief and financial stability. By utilizing top online tools designed for this purpose, individuals can efficiently track repayments, negotiate better terms, and reduce overall costs. Embracing these digital solutions empowers borrowers to take control of their finances, ultimately facilitating a smoother path towards debt freedom.