Car title loan debt consolidation simplifies and improves management of multiple auto title loans by combining them into one larger secured loan with lower monthly payments, extended terms, and potentially reduced interest rates. Individuals benefit from stress reduction, improved financial control, and access to emergency funds, as the process begins with online applications and vehicle inspections, culminating in a single payment for better debt management.

Car title loans can quickly turn into a financial burden, especially when multiple debts pile up. Understanding car title loan debt consolidation offers a potential solution. This article demystifies this process, highlighting its benefits for managing multiple title loans. We’ll guide you through the strategies for creating an effective debt consolidation plan, empowering you to regain control of your finances and drive forward with financial stability.

- Understanding Car Title Loan Debt Consolidation

- Benefits of Consolidating Multiple Title Loans

- Strategies for Effective Debt Consolidation Plan

Understanding Car Title Loan Debt Consolidation

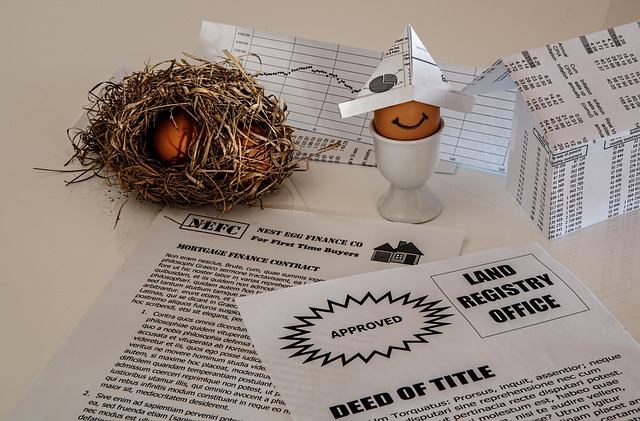

Car title loan debt consolidation is a strategy that allows borrowers with multiple car title loans to combine and simplify their debt obligations. Instead of managing several smaller loans, individuals can consolidate them into one larger loan secured by their vehicle’s title. This approach offers several benefits, including lower monthly payments, extended repayment terms, and potentially reduced interest rates. By refinancing these loans, borrowers can gain better control over their finances and make repaying the debt more manageable.

Understanding Car Title Loan Debt Consolidation involves recognizing that it is a way to restructure existing car title loans, making them easier to manage. The process often begins with assessing loan eligibility, where lenders evaluate the borrower’s financial situation, vehicle value, and repayment history. Once approved, the loans are consolidated into one, providing relief from multiple monthly payments. This method can be particularly beneficial for those dealing with high-interest rates or short repayment terms associated with car title loans.

Benefits of Consolidating Multiple Title Loans

Consolidating multiple car title loans offers significant advantages for borrowers facing overwhelming debt burdens. By bundling these loans into a single, more manageable payment, individuals can simplify their financial obligations and potentially reduce overall interest costs. This approach streamlines repayment schedules, making it easier to stick to a consistent payment plan without the stress of managing multiple due dates.

Moreover, car title loan debt consolidation allows borrowers to access emergency funds once tied up in collateral. After securing a consolidated loan, individuals can free up their vehicles from lien status, providing them with greater financial flexibility. This is particularly beneficial for those needing liquidity to cover unexpected expenses or make necessary repairs. Simplifying the repayment process and regaining control over one’s assets are compelling reasons to explore car title loan debt consolidation through an online application, ensuring a vehicle inspection to assess eligibility.

Strategies for Effective Debt Consolidation Plan

When considering a car title loan debt consolidation for multiple titles, having a strategic plan is essential. The first step involves evaluating your current financial situation and identifying all outstanding loans secured by vehicle titles. This includes gathering details such as loan amounts, interest rates, and repayment terms from each lender. Once this information is organized, compare the terms to understand the overall debt burden. A crucial aspect of consolidation is securing a new loan with a lower interest rate and more favorable repayment conditions, which can significantly reduce the overall cost over time.

An effective strategy involves completing an online application for a consolidated car title loan, providing detailed financial information, including your income and existing debts. The lender will then perform a vehicle valuation to determine the equity in your vehicles. This process enables lenders to offer secured loans with competitive rates since the vehicle serves as collateral. By consolidating multiple titles into one loan, you may achieve better management of your debt through a single payment, simplifying the repayment process.

Car title loan debt consolidation can provide much-needed relief for borrowers struggling with multiple loans. By consolidating these debts, individuals can simplify their repayment process, reduce interest rates, and potentially free up extra cash. This strategic approach allows for better financial management and can be a powerful tool to overcome the challenges of car title loan obligations. Remember, understanding your options and creating an effective debt consolidation plan are key to achieving long-term financial stability.