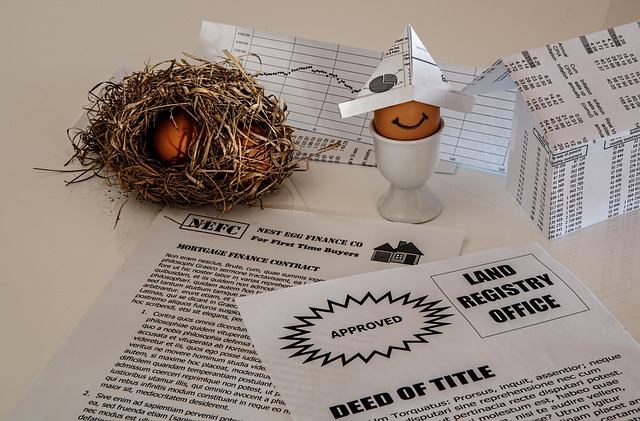

Car title loan debt consolidation is a strategy to bundle multiple high-interest car title loans into one lower-interest, single payment, simplifying repayment and potentially saving money. However, this approach carries risks as it uses your vehicle title as collateral, impacting its value and sellability if you default. Before consolidating, weigh the benefits against extended loan terms, market conditions, and your long-term financial health to make an informed decision.

“Unraveling the mysteries surrounding car title loan debt consolidation—a strategy gaining traction for managing high-interest debt. This article aims to guide you through the process, separating fact from fiction.

We’ll explore the definition and mechanics of this unique approach, revealing its potential benefits and drawbacks. By tackling common myths, such as ‘it’s always the best option’ and ‘your credit will be ruined,’ we empower readers with knowledge. Additionally, we offer insights into alternative solutions, safety measures against scams, and real-world success stories, ensuring informed decisions in the quest for financial freedom.”

- Understanding Car Title Loan Debt Consolidation

- – Definition and how it works

- – Benefits and potential drawbacks

Understanding Car Title Loan Debt Consolidation

Car title loan debt consolidation is a process that involves combining multiple high-interest car title loans into one single loan with a lower interest rate. This strategy helps borrowers manage their debt more effectively by simplifying repayment and potentially saving money on interest expenses. It’s not about getting rid of the loan but making it more manageable, which can be especially beneficial for those dealing with multiple short-term loans.

The title loan process, often involving a cash advance secured against your vehicle’s title, can be enticing due to its accessibility and quick turnaround time. However, understanding that debt consolidation isn’t always the solution is crucial. Loan refinancing might not be suitable for everyone, and it’s essential to weigh the potential benefits against the costs and long-term impact on your financial health, especially considering the risks associated with using your vehicle title as collateral.

– Definition and how it works

Car title loan debt consolidation is a process designed to help individuals manage their high-interest car title loans by combining them into a single, more manageable loan with a lower interest rate. It involves using your vehicle’s title as collateral for the new loan, allowing you to repay multiple debts with one consistent payment. This method can provide significant financial assistance for those struggling with multiple car title loans, simplifying their repayment schedule and potentially saving money on interest charges.

By consolidating car title loans, borrowers can gain clarity and control over their finances. The process typically starts with evaluating the outstanding balance of each loan and determining the overall amount required to pay them off in full. A new loan is then structured to cover these balances, often with a fixed interest rate and extended repayment period. This approach not only streamlines debt management but also preserves vehicle ownership, enabling individuals to retain the use of their asset throughout the consolidation process and beyond.

– Benefits and potential drawbacks

Car title loan debt consolidation offers a unique solution for individuals burdened by multiple car loans or high-interest debt. The primary benefits lie in its ability to streamline repayment, often with lower interest rates and extended terms, providing immediate financial relief. This method allows borrowers to consolidate various car-related debts into a single, manageable payment, simplifying their finances and potentially freeing up emergency funds for other unforeseen expenses.

However, there are potential drawbacks to consider. Extending the loan term can result in paying more interest over time, contrary to the initial appeal of lower monthly payments. Additionally, if the value of the vehicle decreases or there’s a change in market conditions, borrowers might find themselves with limited options, especially if they need to sell the vehicle early to access funds. Balancing the benefits of debt consolidation against these risks is essential for making an informed decision regarding car title loan debt consolidation and maintaining healthy financial habits.

Car title loan debt consolidation is a powerful tool for managing high-interest car loan debts, but it’s not without its nuances. By understanding the process, benefits, and potential drawbacks outlined in this article, you can make an informed decision. While it offers a quicker path to debt resolution than traditional methods, it’s crucial to weigh the advantages against the risks. Car title loan debt consolidation may be a game-changer for those facing overwhelming car loan debts, but it requires careful consideration and planning to ensure a successful and sustainable financial future.